#Sunbiz look up a business free#

Updates are provided free of charge to FUBA members.

#Sunbiz look up a business full#

This is just the beginning of a long regulatory process, and FUBA will continue to monitor this proposal and keep you updated as this develops.Īre you taking full advantage of your FUBA membership? Call us at 80 and ask for Karen, Lance, or Mallory if you want to know more about the benefits FUBA provides to our small business members, such as: Please keep in mind these are only proposed changes, and you do not need to do anything at this time. But that proposal was challenged in court and blocked by a Texas federal judge, so it never went into effect. Under the proposed changes, employees earning $35,308 per year (or $679 a week) and less would have to be paid overtime if they work more than 40 hours.īack in 2016, the DOL tried to make a similar change to the salary cap, so that workers whose salary was under $47,000 a year would qualify for overtime. The DOL’s new proposal would increase the amount of money an employee can make in salary and still qualify for overtime pay. The DOL has just announced a proposal that would make many more workers eligible for overtime pay.Ĭurrently, employees whose annual salary is less than $23,660 (or $455 a week) must be paid overtime if they work more than 40 hours in a workweek. More Workers Would Receive Overtime Pay Under New Federal Overtime RulesĪll businesses are required to comply with the overtime pay regulations put out by the United States Department of Labor (DOL). Even though the Annual Report and filing fees are a State of Florida requirement, we can try to answer any questions you may have. If you have any questions about your Annual Report, you can call the FUBA offices at 80 and ask for Karen or Lance. If you do not file your Annual Report by May 1st, the State of Florida will charge you a mandatory $400 late fee. Payment can be made online using Visa, MasterCard, American Express or Discover, and Visa and MasterCard debit cards are also accepted. For LLC’s, the filing fee is $138.75, if filed by May 1st. A valid email address that is regularly monitored.įor corporations, the cost to file an Annual Report is $150, if filed by May 1st.

Your company’s Federal Employer Identification Number (FEIN), if applicable.

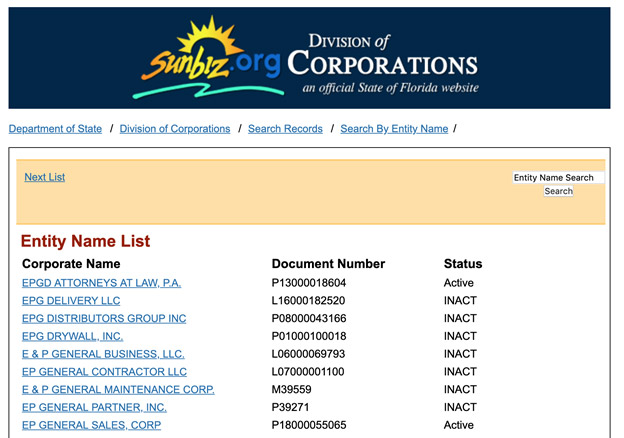

This allows you to search for your company and find the document number. It will be in the email notice you should have already received from the Division of Corporations, or you can find it by clicking on the “Forgot Number?” tab on the Annual Report screen. This is a 6 or 12-digit number that was assigned to your company by the Division of Corporations when you first created your business entity. To complete your Annual Report, you will need the following: To file your Annual Report, go to and click on the “ Annual Report” under the “Filing Services” tab.” If there isn’t an Annual Report listed for the year 2019, you need to file your Annual Report by May 1st. If you see an Annual Report filed for 2019, you are all set. If you scroll down towards the bottom of the screen, you will see a section called “Annual Reports” which lists all the Annual Reports your company has filed with the State of Florida. You will see the information about your company that the state of Florida has on file. Find your company’s name in the list and click on it. Not sure if you have already filed it and want to double-check? Go to the state Division of Corporations’ website at and click on “ Look Up a Business.” To search by your company’s name, click on “Name.” Enter your company’s name, and a list will pop up. If you have already filed your Annual Report for 2019, you can disregard this reminder. The only exception to this requirement is for corporations and LLC’s that were initially formed in 2019 these entities will not have to file an Annual Report until 2020. All Florida corporations and LLC’s must file an Annual Report by May 1st with the State of Florida’s Department of State at. If your business is a Florida corporation (INC) or limited liability company (LLC), you only have a few more weeks to file your company’s Annual Report with the State of Florida. April 2019 Corporations and LLC’s: Time is Running Out to File Your 2019 Annual Report

0 kommentar(er)

0 kommentar(er)